Building Your Legacy with HDSA

At HDSA, FAMILY IS EVERYTHING....make sure yours is protected.

HOW TO GET STARTED

No matter your stage in life, it is never too early to think about your future and plan for how your affairs will be handled when you are gone. With just a few simple steps and legal instructions, you can have peace of mind for tomorrow.

Explore your planned giving options, or use our FREE online tool to create your estate plan, and include a legacy gift to HDSA. Courtesy of our partnership in FreeWill, this tool guides you through the process in 20 minutes or less and makes it easier than ever to join the Marjorie Guthrie Society with a lasting commitment to HD research and support.

Start writing your free will here

YOUR GIVING OPTIONS

HDSA’s gift planning options

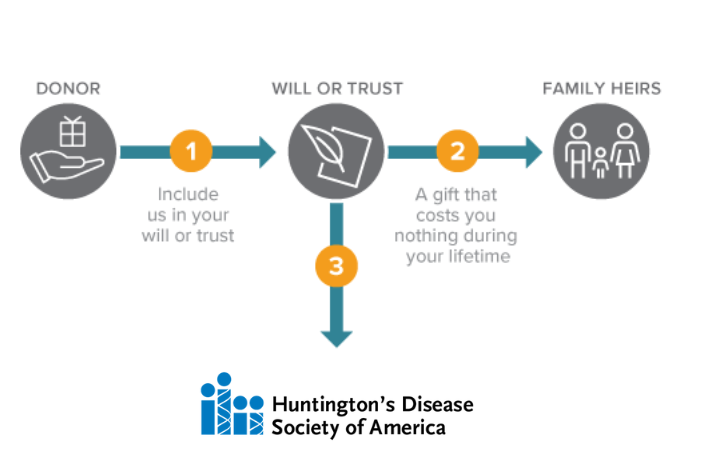

Gifts in Wills

Leaving funds to HDSA is a meaningful way to ensure HDSA’s future financial and security while you save on estate taxes. A bequest to HDSA, fully deductible for estate tax purposes, might place your estate in a lower tax bracket. You may bequest cash, property or appreciated securities.

An unrestricted gift enables HDSA to use the funds to support whatever programs deems most urgent at the time. Or you can specify how your gift will be used. If you plan to make a restricted gift, kindly contact HDSA to ensure that we can meet the conditions specified in your will.

Creating your Estate Plan

We’ve partnered with FreeWill to help you write your will for free! This secure online resource helps you complete your will in 20 minutes from the comfort of your home. If you have a complex estate or prefer to finalize your will with an attorney, this tool can also be used to create a list of documented wishes, saving you time and money.

Start writing your will for free here

Stocks, Appreciated Assets, and Real Estate Donations

Whether purchased for love or investment purposes, publicly traded stocks, real estate, shares in a privately held company, interests in private equity, hedge funds, and fine art or collectibles can prove to be the best items to donate to HDSA to realize maximum tax benefits. Assets that have appreciated in value can be among the most tax-advantaged items to contribute to HDSA because you can enjoy a current year tax deduction and avoid payment of capital gains taxes on their sale. This allows you to pay lower taxes and also allows HDSA a maximum fiscal benefit.

Life Insurance

The easiest type of planned gift to make to HDSA. Most people own life insurance policies. Many have outlived their original purpose. By contributing your policy to HDSA, you are entitled to a tax deduction for the policy’s full cash value. You can transfer ownership of a policy to HDSA or simply name HDSA as a primary or secondary beneficiary of the policy.

Trusts

A legal agreement under which a donor funds a trust that provides income to the beneficiaries for life, or for a term of years, after which the remainder of the trust is distributed to HDSA and/or to other charitable organizations. This kind of trust allows you to lower your tax impact by your pledging some of your assets to HDSA while you receive yearly income payments. For the donor who has highly appreciated, non-income or low income-producing assets, converting those assets into income can result in high capital gains taxes on the appreciation. By transferring the asset to a charitable remainder trust, the donor can create a tax-free environment in which to sell the appreciated asset. This enables the trustee to reinvest the entire proceeds and produce a higher income stream. There are several different types of trusts that you can establish with HDSA as a beneficiary that will reduce your tax burden.

-

Charitable Remainder Unitrust

The most common kind of trust vehicle. After establishing this trust, the donor receives an annual lifetime income. Upon the donor’s death, the charity receives the rest of the trust. In this kind of trust, the donor usually retains the right to a fixed percentage of the fair market value of the trust assets, to be valued annually. If the value of the trust assets increases, so does the annual return. If the value of the trust assets decreases, the annual return decreases. -

Charitable Remainder Annuity Trust

Similar to the Unitrust above but pays a fixed dollar annuity each year, year after year. The increase or decrease in the value of the trust does not affect the yearly payout to the donor. -

Charitable Lead Trust

This trust is the opposite of a charitable remainder trust. It is an excellent method of supporting HDSA while you are alive. When you establish a Charitable Lead Trust, HDSA receives income for a set number of years. At the end of the set time period, your heirs inherit the assets of the trust

THE MARJORIE GUTHRIE SOCIETY

The HDSA Legacy Giving Society

Until the day when scientists find a cure for HD, families across the country require access to the crucial research, care, education, and advocacy programs HDSA provides. The Marjorie Guthrie Society ensures that as we look to the future we’ll have the resources we need to continue providing help and hope to the HD community.

By including HDSA in your estate plans as the beneficiary of insurance, real estate, appreciated securities, or retirement plan you can create a legacy of giving that guarantees future generations will have the vital support they need to confront this devastating illness. With the help of a financial planner, you can arrange your gift in a way that reduces your estate taxes and has the strongest possible impact on the lives of those affected by HD in the decades to come.

For more information please contact legacy@hdsa.org