Understanding “Other” Insurance and HD

Over the past two weeks the Disability Tips blog has covered disability insurance and health insurance. What remains is all the “other” types of insurances: life, accident, hospital, critical care, and long-term care. Choosing the right insurance can be overwhelming because there are so many different types. Each type of insurance provides unique coverage, which is not needed by everyone. Where do you begin?

The three main questions that arise for Huntington’s disease families about all insurance are:

1. Is my right to obtain insurance protected since I have a genetic disease?

2. What types of insurance do I need to provide the most protection for myself and my family?

3. When do I need to purchase insurance?

These questions are very important to every HD disability journey, and the sooner you get the answers to these questions, the better.

1. Right to Insurance – Genetic Information Nondiscrimination Act (GINA)

No, anyone at risk for or diagnosed with HD does not have a protected right to obtain most insurance. GINA does not protect any individual’s right to obtain “other” insurance or disability insurance. It only protects access to health insurance and your right to employment.

2. Types of Insurance

Monthly insurance premiums can be very expensive and not everyone can afford additional insurance policies. Deciding what insurance policies are right for your/your family will depend on your specific needs, premium costs, and benefits provided. The two kinds of insurance that EVERYONE needs are disability and health insurance, everything else is up to you:

Life insurance

Life insurance helps family/dependents/beneficiaries with expenses when YOU die. This is a benefit you want to obtain if you want to make sure your loved ones have financial assistance when you die.

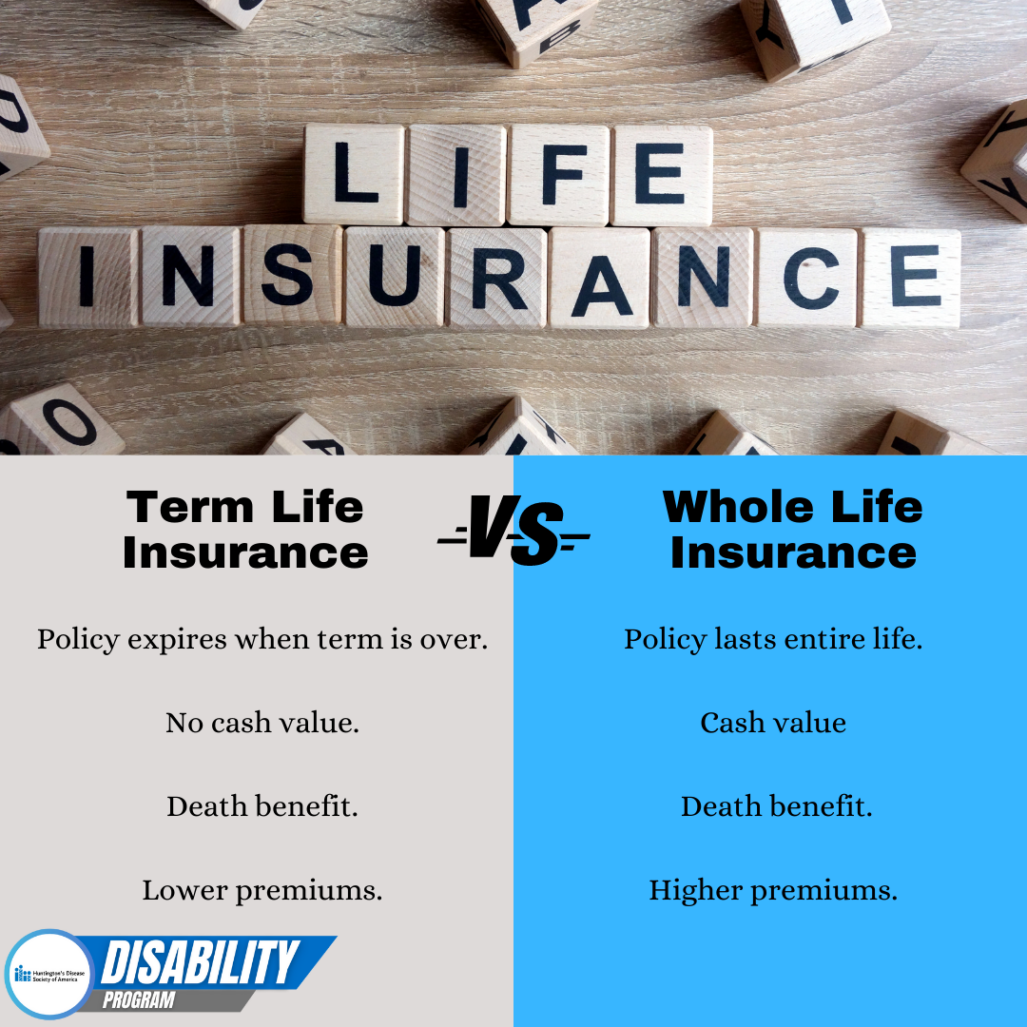

- Term Life – Term life policies last for a set number of years and are much cheaper than whole life policies. Term life policies typically last between 10 years and 30 years, and they don’t have any complex tax implications or restrictions.

- Whole Life – Whole life policies are a type of permanent life insurance that lasts your entire life. They are five to 15 times more expensive than term life but come with a cash value separate from the death benefit.

Accident Insurance

Accident insurance offers a payout if you experience injury or death due to an accident. Accidents covered by the policy will be specifically listed in the policy. If you are involved in an accident, you can use the pay out from the accident insurance however you wish.

Hospital Insurance

Hospital insurance can help cover the costs of a hospital stay for covered illness and injury, general hospitalizations, intensive care, and critical care. If you are considering having children, hospital insurance does include childbirth. You will need to read through any potential policy to see if it is the right fit for you.

Critical Care Insurance

Critical Care insurance provides a lump-sum cash benefit to help cover expenses associated with a qualifying serious illness. The list of covered conditions is very specific and does not often include Huntington’s Disease.

Long-term Care Insurance

Long-term care insurance is designed to cover long-term services and support. This includes personal and custodial care in your home, a community organization, or other facility. Long-term care insurance reimburses you for services to assist with activities of daily living such as bathing, dressing, or eating. Most policies reimburse 80% of costs so you will still be responsible for paying 20% of costs out of pocket. *Anyone with a family history of HD will not be eligible for long-term care insurance unless they have a negative gene test.*

3. Purchasing Insurance

When it comes to HD, the earlier you purchase insurance, the better. Once someone gets a positive gene test, a clinical diagnosis, or starts to show symptoms of HD, they are no longer able to purchase insurance – their application will be denied. Most of the insurance listed above is highly recommended/necessary whether a person has HD or not. Many of these policies are things you should opt into when you are offered benefits with your first job.

Insurance is a very personal choice. Hopefully this information will help you make the best choice for you.