Health Insurance Benefits and the Marketplace

This week’s disability blog has a special guest contributor, HDSA’s Madeline Burbank, Disability Intern.

During Open Enrollment, everyone has the opportunity to choose the health insurance plan that fits them best. This article will answer commonly asked questions about health insurance benefits and the marketplace, especially for those who are eligible for Medicare. Visit Healthcare.gov for more information, or to take your first steps to enrollment.

What are the factors to consider?

When choosing a health insurance plan, it is important to consider timing, costs, coverage, categories, plan and network types, the impact of recent legislation, and where to find assistance.

Timing

Open Enrollment for health insurance stretches from November 1 to January 15. But this time flies quickly, especially if you’re just starting to consider your options. For coverage to begin on January 1, 2026, be sure to enroll by December 15, 2025. Enrolling between December 15 and the January 15 deadline means a new plan won’t start until February 1, 2026. Be careful to avoid a coverage gap or unwanted automatic renewal. Outside of Open Enrollment, people can only make changes for qualifying life events such as getting married or losing a job-sponsored health insurance plan.

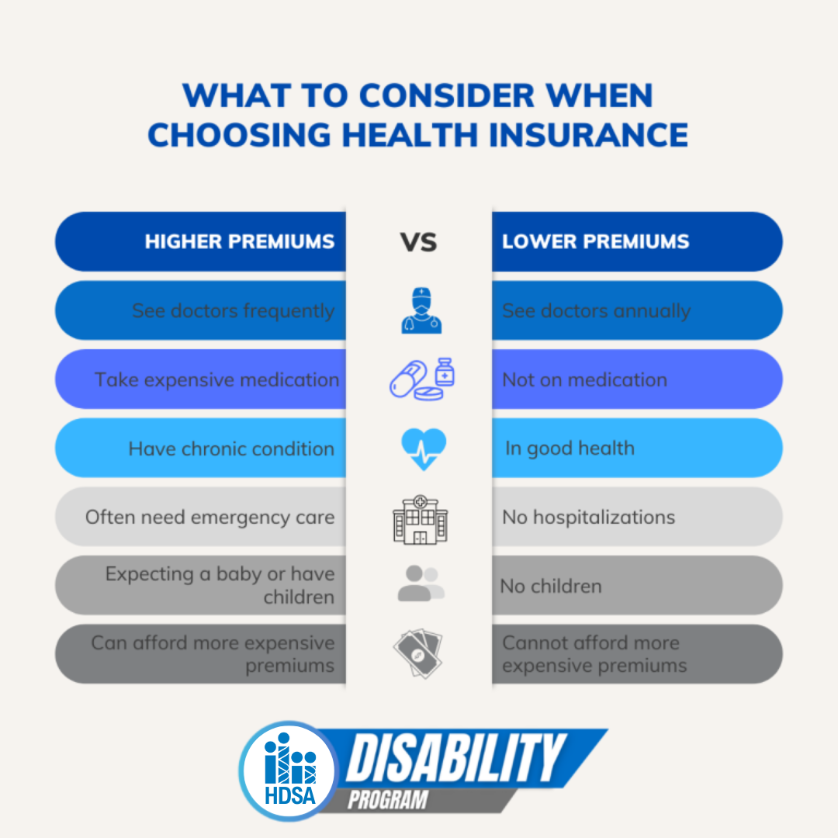

Costs

Costs include the monthly premium, deductibles, and out-of-pocket costs (i.e. copays, your portion of the bill). Importantly, government-administered Medicare also requires a monthly premium, which will be $202.90 per month in 2026. This is automatically deducted from monthly Social Security disability and retirement income.

Categories

Health insurance plans are often described by categories like Bronze, Silver, Gold, and Platinum. These categories only refer to plan sharing costs and have nothing to do with quality of care. A Bronze plan might have lower premiums and higher copays while a Platinum plan might have higher premiums and lower copays, all in the same network.

Coverage

Ideally, your plan will cover all the medical providers you currently visit, and help pay for your important medications. When looking at plans, remember you are only choosing a plan for the next year, not the rest of your life. Pick a plan based on your current needs or anything you anticipate needing over the next year (like having a baby). Do not feel obligated to buy a more expensive plan if you do not need it. For more information, watch the Disability Chat Webinar about Navigating Health Insurance.

Plan and Network types

There are four different plan types:

- HMO: Health Maintenance Organization

- PPO: Preferred Provider Organization

- EPO: Exclusive Provider Organization

- POS: Point of Service Plan

Depending on your plan type, either you choose your own doctors and specialists, or your doctor decides what specialists you can see.

- HMO & POS Plans – Require a visit to your primary care physician before a procedure or specialist visit can be scheduled; Tend to be cheapest health plans.

- PPO & EPO Plans – Allow you to choose your own specialists; better for HD care because of flexibility to choose doctors; More expensive.

Medicare Parts

Read more facts about Medicare on our website, whether you’re currently receiving Medicare or planning for it someday.

- Part A – Hospital Coverage

- Part B – Medical Coverage

- Part C – Medicare Advantage

- Part D – Prescription Coverage

Did the government shutdown have anything to do with health insurance?

In 2010, the introduction of the Affordable Care Act (ACA) established premium tax credits to help eligible households effectively lower their health insurance premium costs. The health premium tax credits were later expanded due to financial difficulties caused by the pandemic. These tax credits expanded both eligibility and the subsidy itself, helping more people pay less for healthcare. Unfortunately, the tax credit legislation was not permanent, and the question of extending the tax credits sparked the standoff that triggered the recent 2025 government shutdown. The shutdown also ended Medicare funding and flexibility that had allowed expanded telehealth access since 2020. Ultimately, the new spending plan was passed without extending telehealth flexibility or enhancements for health premium tax credits.

How will I be impacted by the change to premium tax credits?

Health premium tax credits primarily impact people who independently purchase plans through ACA exchanges, not those on Medicare or job-sponsored plans. As explained in a Congressional Research Service report by Bernadette Fernandez, the premium tax credits will still exist in 2026. Since the affordability enhancements will expire, monthly premiums will be more expensive for many Americans. This higher cost is a factor to consider when choosing a policy. At the same time, keep in mind that plans designed with low monthly premiums tend to have higher out-of-pocket expenses. These out-of-pocket expenses may end up costing more money in the long run.

Is telehealth still an option?

Telehealth is still an option for many services, but with changes to Medicare and Medicaid, more patients will be expected to make in-person appointments. HD patients are especially affected by the news that physical therapists, occupational therapists, and speech-language pathologists will no longer be able to bill Medicare for telehealth services starting January 31, 2026. Read more in the FAQ overview published by the Centers for Medicare & Medicaid Services. For those enrolling in private health insurance, be sure to check if your plan covers the telehealth services you need.

Who can help me make Medicare decisions?

The State Health Insurance Assistance Program (SHIP) provides free Medicare counseling assistance. As stated on their website, “SHIP offers confidential, unbiased guidance from trained and certified Medicare experts to help you make important decisions about your care and benefits.” There are local SHIP services in each of the 50 states, Puerto Rico, Guam, the District of Columbia, and the U.S. Virgin Islands. Find your local office through the SHIP website, or call 1-877-839-2675 for assistance.

Contact Us

If you have questions, you can always Ask Allison.