What to Expect When Applying for Marketplace Health Insurance

December is not only the time of year that reflects the holiday season, it is also the time of year that many people are enrolling in health insurance coverage for the next year. The last day to enroll in Marketplace Health Insurance for plans starting January 1, 2023, is December 15, 2022.

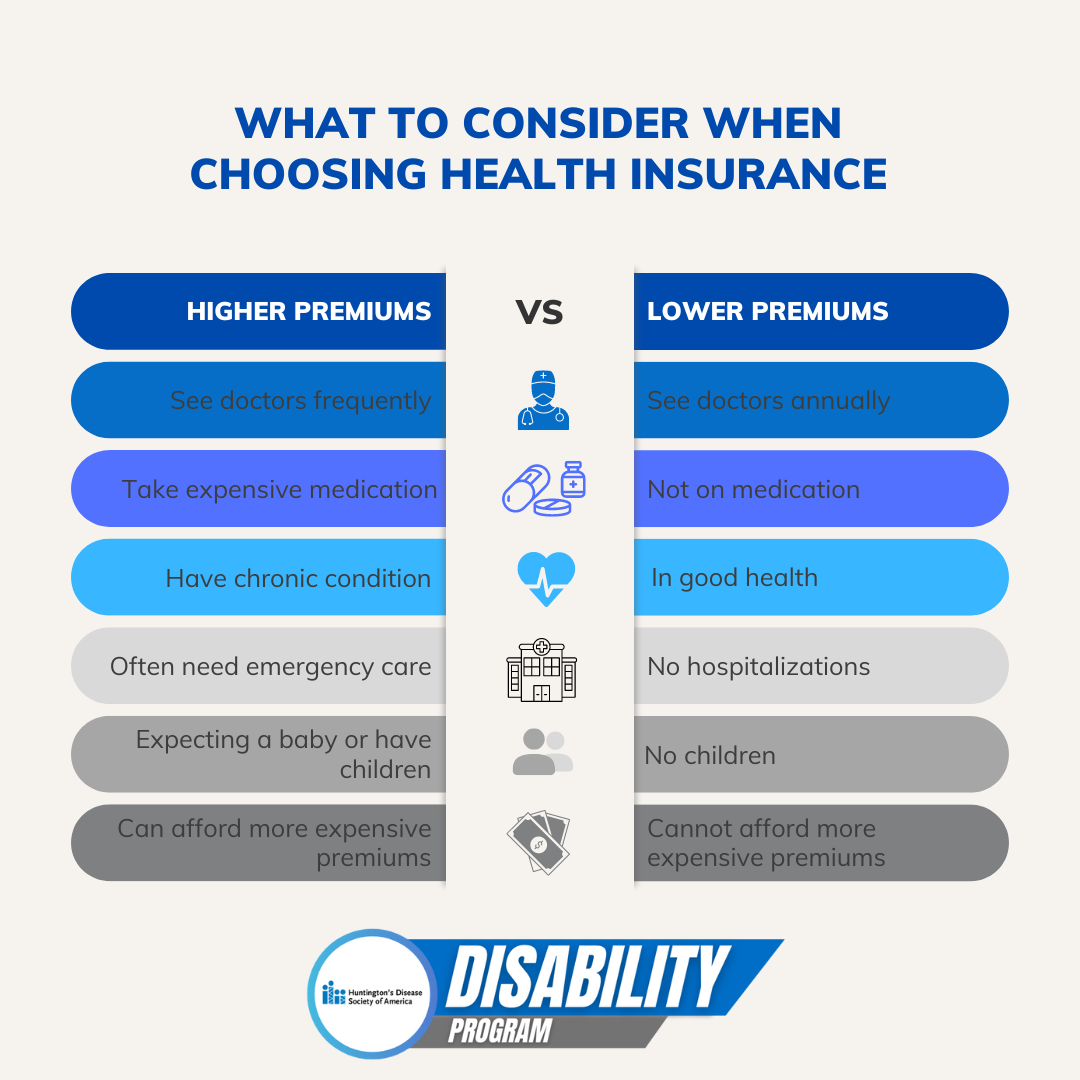

Finding the right health insurance plan can be confusing with the various plans, terminology, and cost structures – it is hard to know what everything really means. When choosing a health insurance plan, it is important to take these five factors into consideration:

1. Costs – It is important to look at all of the plan costs, not just the monthly premium because a plan with a low monthly premium may end up costing your more money over the course of the year. Health insurance plan costs include:

- Monthly premium

- Out of pocket costs (copays, your portion of bill)

- Deductibles

2. Categories – Health insurance plans are broken into four metal categories (Bronze, Silver, Gold, Platinum). These categories only refer to plan sharing costs and have nothing to do with quality of care.

3. Plan and Network types – There are four different plan types:

- HMO: Health Maintenance Organization

- PPO: Preferred Provider Organization

- EPO: Exclusive Provider Organization

- POS: Point of Service Plan

Plan type matters because it can be the difference between you choosing your own doctors and specialists or having your doctor decide what specialists you can see.

- HMO & POS Plans – Require a visit to your primary care physician (PCP) before a procedure or specialist visit can be scheduled; Tend to be cheapest health plans.

- PPO & EPO Plans – Allow you to choose your own specialists; better for HD care because of flexibility to choose doctors; More expensive.

4. Coverage of current doctors – It is very important to make sure all of your current doctors are covered by the plan you choose.

5. Coverage of current medication.

When looking at plans, remember you are only choosing a plan for the next year, not the rest of your life. Pick a plan based on your current needs or anything you anticipate needing over the next year (like having a baby). Do not feel obligated to buy a more expensive plan if you do not need it. For more information, watch the helpful Disability Chat Webinar Navigating Health Insurance.