Understanding SSDI Medicare Enrollment

Over the past few weeks, the blog has touched on a number of benefits and other considerations when getting approved for Social Security disability insurance (SSDI). A significant benefit that comes with SSDI is Medicare. Everyone approved for SSDI is automatically enrolled in Medicare, but what does that really mean? Today we are going to answer some common Medicare questions.

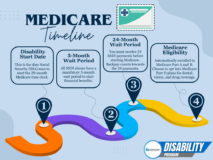

What is the Medicare timeline?

Once a person is approved for SSDI, they must receive 24 qualifying disability payments before Medicare starts, in addition to the 5-month waiting period. This means there is actually a 29-month total waiting period. Backpay and past due benefits count towards the 24 qualifying payments, which means very few HD families have to wait the full 24 months.

For example, you became disabled on January 1, 2022, submitted a disability application on April 5, 2022, and got approved October 6, 2022. Your Medicare benefits should start May 1, 2024. Social Security starts the Medicare clock from the date you became disabled, not the date you start the application or the date you are approved. If you became disabled on January 1, 2022, then the 5-month waiting period ends May 1, 2022, which starts the 24-month clock that will end May 1, 2024.

What Medicare Benefits are included?

Medicare insurance comes in four parts:

- Part A – Hospital coverage

- Part B – Medical Coverage

- Part C – Medicare Advantage

- Part D – Prescription Coverage

SSDI Medicare only includes Part A and Part B. If you would like Part C or Part D, then you have to enroll in them separately. You get a special enrollment period when your Medicare starts, otherwise you can enroll in these plans during the annual open enrollment period: October 15, 2023 – December 7, 2023.

What does Medicare cost?

While Medicare is included with SSDI, you are still responsible for paying the monthly premium of $164.90. This amount is automatically deducted from your disability check.

Can I get financial assistance for Medicare?

If your SSDI amount is less than $1,660 per month, then you may be eligible for additional financial assistance. There are 4 different Medicare assistance programs:

- Qualified Medicare Beneficiary Program – helps pay for Part A & B premiums, deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary Program – helps pay for Part B premiums.

- Qualifying Individual Program – helps pay for Part B premiums.

- Qualified Disabled & Working Individual Program – helps pay for Part A premiums only and you must be working.

You can learn more here.

Do I have to take Medicare?

No, you can waive Medicare Part B coverage as long as your insurance (or coverage from your spouse) meets certain criteria. Go to Medicare Rights Center for more information about waiver criteria. You can only waive Medicare Part A if you have to pay a premium for it. There are two ways to drop coverage:

- Contact Social Security.

- If you recently received a Medicare welcome packet regarding your automatic enrollment, follow the instructions and mail back your Medicare card. If you keep the card, then you agree to Part B Medicare coverage, and you will start paying the monthly premium.

To make sure you are getting the most out of your Medicare benefit, you can call your State Health Insurance Assistance Program: https://www.shiphelp.org/

Contact Us

If you have questions, you can always Ask Allison!