Understanding Social Security Disability and Taxes

The old saying goes, “nothing in this world is certain except death and taxes.” This statement holds true even for Social Security disability. While no one wants to pay taxes, it is important to understand your tax liability. No one wants to get in trouble with the IRS. Specifically, there are different tax rules depending on the type of disability you receive: Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), or a lump sum back payment.

Supplemental Security Income

If you receive SSI, then your benefits are not taxable. Importantly, you are not obligated to file taxes if you have no taxable income, or you make less than $12,950 per year. NOTE: If you are working and receive SSI it is beneficial to file taxes to ensure you receive all your work credits for SSDI eligibility.

Social Security Disability Insurance

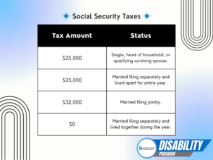

If you receive SSDI then you may have to pay taxes based on your yearly income and marital status. Fortunately, you will not be taxed on your benefit unless your total income is over these amounts:

However, your tax liability does not start until you reach the tax minimum. This means you will not be taxed on your benefits until your income reaches $25,000 or $32,000 based on your filing status. You can opt into tax deductions in order to reduce the amount you owe on your yearly tax return. This is especially helpful if you think you will owe taxes at the end of the year.

Additionally, you will receive an SSA-1099 so you can report the taxable portion of your benefits when completing your yearly tax return. You can find more detailed information here.

Lump Sum Back Payment

If you only receive SSI, your back pay is not taxable. If you receive SSDI, your back pay is taxable. This means a large lump sum back payment can cause concern for tax liability. Fortunately, the IRS allows you to assign back pay benefits to the year they should have been received. This method is called the “lump-sum election” method and you can read more here.

Contact Us

If you have questions, you can always Ask Allison!