Understanding Financial Planning and HD

Financial planning is an equally important part of the Disability Umbrella because there are many costs associated with Huntington’s disease. These costs include medical care, medication, disability and loss of work income, legal planning, home modifications, and nursing care. Many of these costs can be a large financial burden for families. Financial planning can help reduce this burden.

The purpose of financial planning is to create a plan to achieve your short and long-term financial goals. This is not something you do once, but something you should re-evaluate as you meet your goals and/or your needs change. It is important to make sure you are on-track to meet your personal goals. It is also important to remember that these goals should include fun and meaningful events in your life, like a vacation or a wedding.

There are four basic steps to financial planning:

- Review your financial situation and typical expenses;

- Set your financial goals;

- Create a plan that reflects the present and the future;

- Fund your goals through saving and investing.

While these steps are not complicated, it can be very beneficial to work with a licensed financial planner. A financial planner can help walk you through this process and create the right plan for you. Additionally, many financial planners can help manage investments. If you do not feel comfortable navigating this process on your own, you do not have to. You can find information about finding a financial planner here.

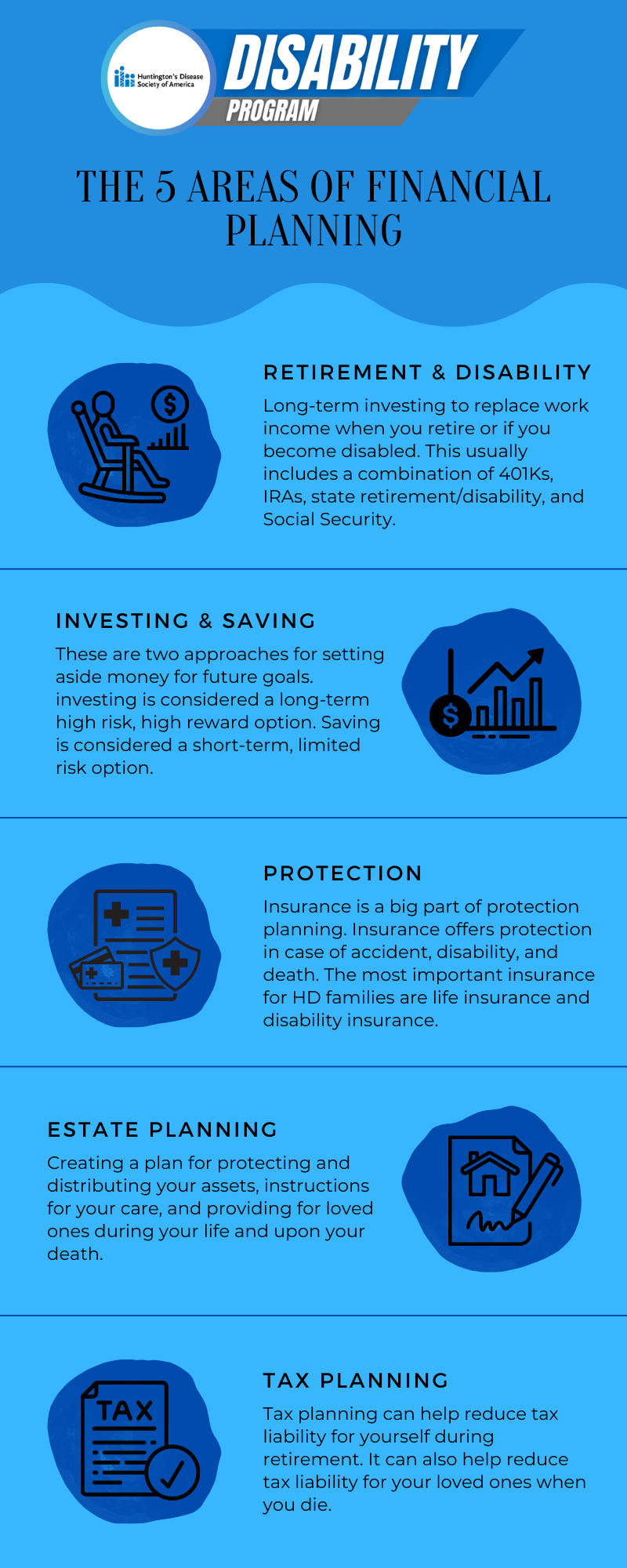

In addition, a financial planner will make sure that your financial plan includes all of the necessary pieces. A strong financial plan should include:

- Retirement and disability

- Investments

- Insurance protection

- Estate planning

- Tax planning

The sooner you start financial planning, the better. It will help give you more control over your financial future. It will also help set realistic goals and expectations. Equally important, the sooner you start saving and investing, the more you can save.