Understanding Long-term Care Planning and HD

Long-term care planning is the culmination of all the Disability Umbrella categories. By the time a loved one needs long-term care, they should already have everything in place:

- Disability benefits;

- Medicare/Medicaid;

- Financial plan to pay for the care;

- Appropriate legal documents for decision making and to ensure their wishes are honored.

Having these things in place will make it easier to choose the right care option, whether it is staying at home or going to a care facility.

Home Care

Home care is care that allows the person with HD to stay in their home. This often includes hiring a caregiver to come in regularly to help with activities of daily living and any other medical needs. When considering in-home care, it is also important to consider the needs of the family caregivers and how much care they can actually provide. First, make a list of everything the loved one with HD needs help with on a daily, weekly, and monthly basis. Second, realistically think about how much help yourself, family, friends, or neighbors can provide. This is likely long-term, not something that will last just a few weeks or months.

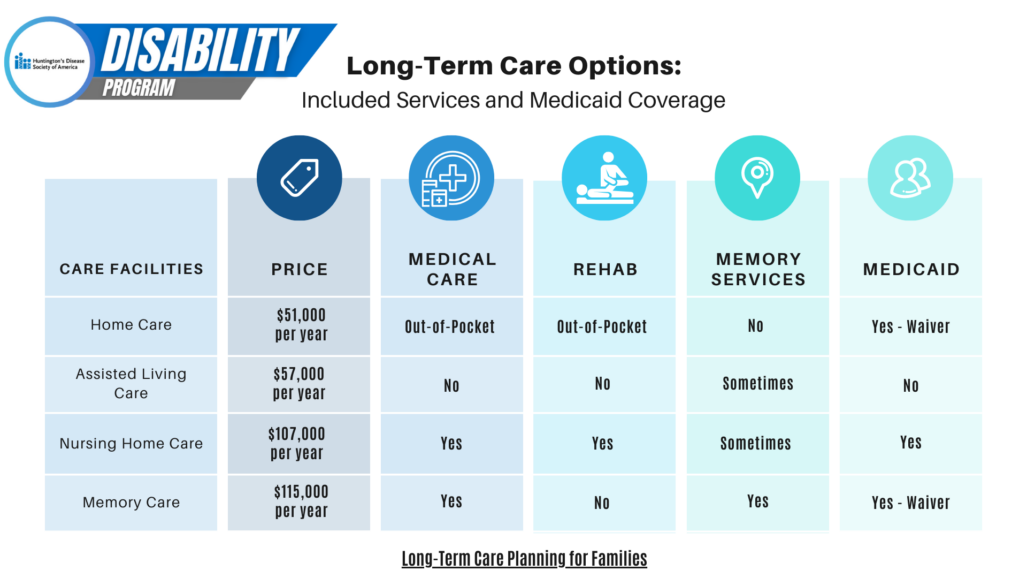

The average cost of in-home care averages $51,000 per year. Every state has a Medicaid waiver program that provides in-home care assistance. This includes case management (i.e. supports and service coordination), homemaker, home health aide, personal care, adult day health services, habilitation (both day and residential), and respite care. The waitlist for Medicaid waivers services is often long and you have to be Medicaid eligible before you can apply for a waiver. There is a 5-year look back period for Medicaid that includes all transferred, sold, and gifted assets – this is not something that can be done at the last minute.

Assisted Living Care

Assisted living is for people who need some help with daily care, but still maintain a level of independence. These facilities often offer a variety of care levels and accommodations, from full apartments with kitchens to single rooms. Residents have access to many services, including daily meals, personal care assistance, medication, assistance, housekeeping, and 24-hour supervision. Assisted living facilities do not provide the same level of medical care as nursing homes, and don’t normally have medical personnel on staff

A year in a 1-bedroom assisted living facility averages $57,000 per year. Medicare does not cover assisted living costs and Medicaid only provides some level of assistance – it is state dependent. Find more about your state here.

Nursing Home Care

Nursing homes, also called skilled nursing facilities, offer both health and personal care services. These facilities focus more on medical care and rehabilitation. They include services like nursing care, daily meals, assistance with activities of daily living, and physical, occupational, and speech therapy. Nursing homes were designed for individuals that require constant care and supervision.

The average cost of care in a private long-term nursing home is $107,000 per year. Medicare only covers a maximum of 100 days of services after a hospital stay then the rest will be out of pocket. Medicaid helps cover the full cost of nursing home care at designated facilities. Medicaid eligibility for nursing home care is different from regular Medicaid and you can find your state criteria here.

Memory Care

Memory care facilities are essentially specialized nursing care facilities. They offer similar health and personal care services, but memory care facilities offer additional memory-enhancing therapies and safety measures. Memory care facilities have specially trained staff that are familiar with dementia and memory care complexities. These facilities also have more safety features for the protection of the residents and to reduce wandering.

The average cost of care in a private memory care facility is $115,000 per year. Medicare does not cover these costs. Medicaid will cover these costs for a nursing home that offers memory care, but not assisted living that offers memory care. Some states have grant programs to help cover the cost of memory care, which you can find here.

Transitioning a loved one to long-term can be difficult so keep these 5 tips in mind:

1. Manage your expectations – this process is going to be hard.

2. Research different facilities in your area, know what services they can provide, and how they can manage your loved one.

3. Be prepared to advocate for your loved one and use your HD expertise to make sure your loved one gets the care they need.

4. Know your loved one’s patient rights.

5. Contact your Ombudsman if you have any issues with the facility.

HDSA has a number of helpful long-term care planning resources that you can find here.