Knowing Your Disability/Retirement Benefit Program

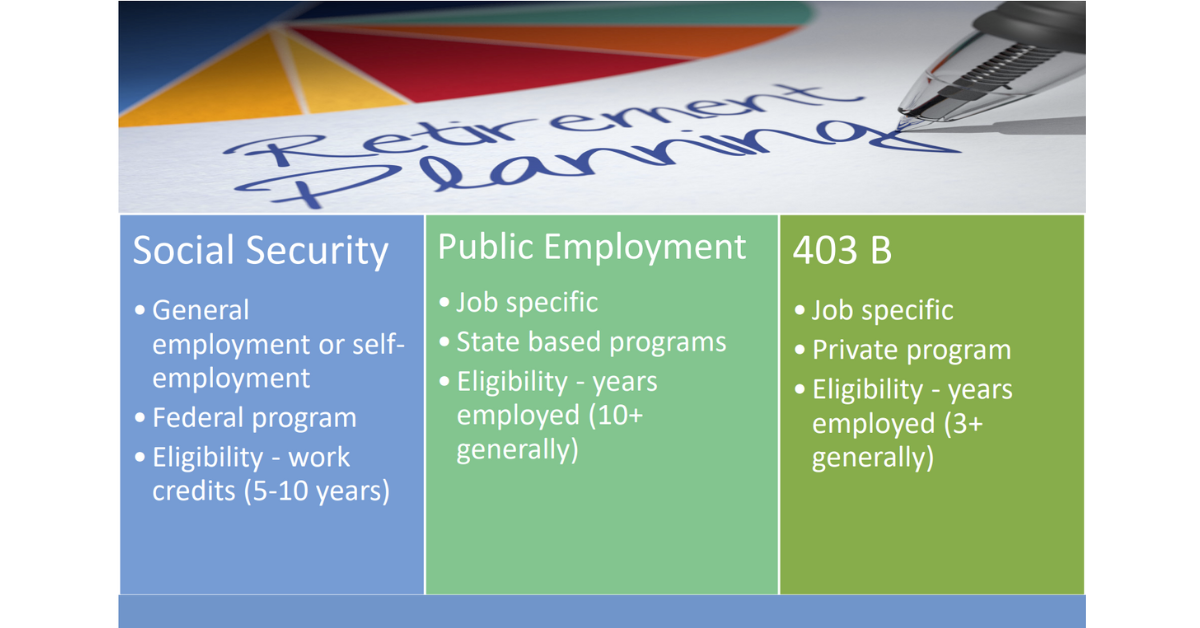

Whether you have a disabling condition, like HD, or you just want to make sure you are protected if you have to stop working, it is very important to understand your disability/retirement benefit program and options so you do not miss out on benefits when you need them. There are three different types of disability/retirement programs that Americans pay into through their employer: Social Security, public employment programs, and private 403(b) programs.

Most Americans pay into Social Security (SSA) through payroll taxes. This means if you see SSA taxes on your W-2 that you will need to apply for SSA disability if you stop working due to your HD. SSA disability and retirement eligibility is based on work credits – every American can earn up to 4 quarters of credits per year. To be eligible for SSA retirement you need to earn 40 quarters of credits, meaning you need to work for 10 years. To be eligible for SSA disability, you need 20 quarters of credits that have to be earned in a 10-year period, meaning you need to have worked 5 out of the last 10 years. You can find more information here.

If you work in public employment (state government, Police, fire department, teacher), then you likely pay into a public retirement program, which can be a state retirement system, a teacher retirement system, a police retirement system, etc. Some public employers pay into Social Security and a state retirement system, other public employers just pay into the public retirement system. If you just pay into a public retirement system (Ohio Public Education Retirement System, Teachers Retirement System of Louisiana, etc.) then you can only take disability or retirement from that system. Most public retirement systems require you pay into the system for at least 10 years to achieve full retirement and disability benefits. This means you risk losing the chance for disability or retirement benefits if you leave the state before you have reached 10 years.

If you work in public employment and you know you cannot commit to living in a specific state for 10 years and you do not pay into Social Security, then you can choose a private 401(3)(b) programs because it follows you wherever you work. These plans work most similarly to a traditional IRA, but there are special disability exceptions if you need to take out money early because of a disabling condition. You can find more information here.

Whatever plan you pay into, it is important to understand the differences and eligibility criteria.