Disability Insurance Benefits

When starting down the long road of disability planning for HD, one of the best places to start is with Disability Insurance benefits. Disability insurance benefits provide income if a person is no longer able to work because of a disabling condition or accident. This is a great place to start because all disability insurance benefits, whether they are public, employer provided, or private, all require you pay into the policy for at least a year before you can utilize the benefit. Most government provided benefits require you pay into the program for 5-10 years first, and the amount of time you pay in directly impacts how much you could get in a monthly disability check. The general rule with disability insurance is: start paying into the insurance long before you need disability benefits to make sure you meet the eligibility criteria and get as much income as possible.

The disability insurance process starts as soon as a person enters the workforce with their first job, whether they are 15 or 25. Employees might pay into Social Security, the federal retirement system, a state retirement system, a public education retirement system, or a combination of multiple retirement systems. These are generally referred to as public disability benefit systems and people pay into these benefit systems through taxes deducted from paychecks – you do not opt into these programs; you are automatically enrolled based on the type of employment.

In addition to paying into these public benefits, some employers offer private short-term and long-term disability policy options. Employer provided disability policies are always subsidized by the employer, making them very affordable and cost effective. If your employer offers short/long-term disability benefits, you should ALWAYS opt into the policies – it is very important to know that maternity is not provided by the Federal government and by most employers, the only way to guarantee paid leave is to take short-term disability.

A person can also purchase disability insurance directly from an insurance company. This is more expensive than getting it through an employer, but not every employer offers short-term or long-term disability, and employer provided insurance is only accessible while you are employed at that specific job, it is not transferable. A private disability policy will be accessible at any point, regardless of employer, as long as you continue to pay into the policy.

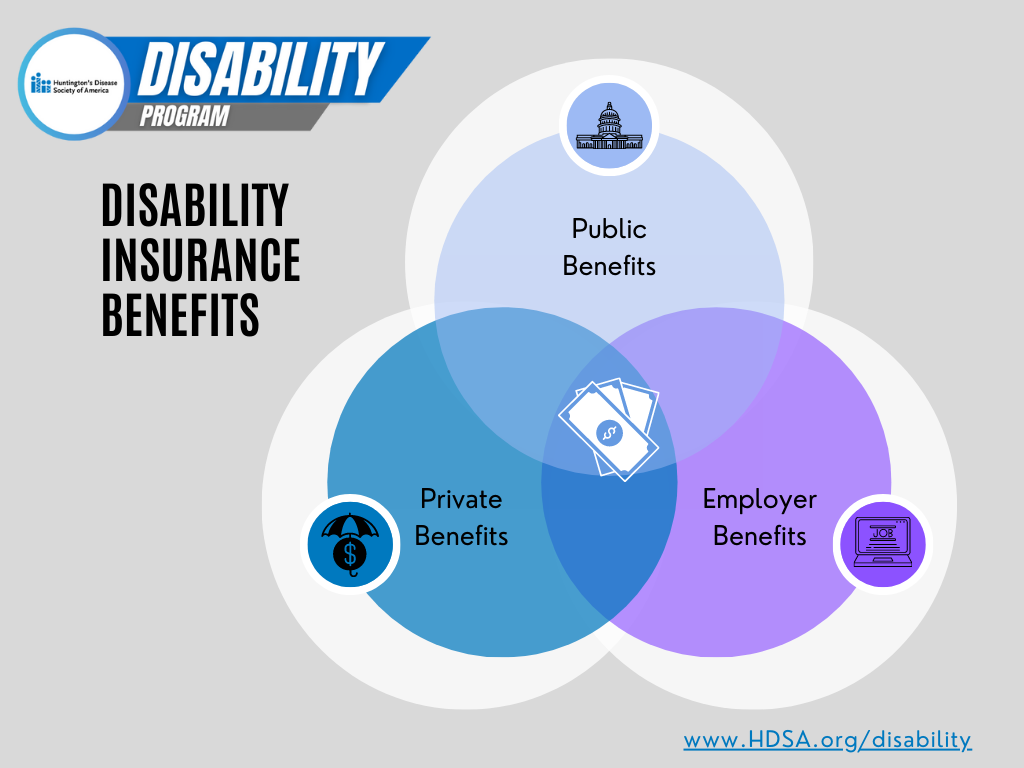

The great thing about public, employer, and private benefits is they are not exclusive, you can have all of these benefits at once. They create a Venn diagram of financial protection.

You can find more information about all of these benefits here: HDSA Disability Chat Public & Private Benefits