Understanding Social Security Work Credits

To qualify for Social Security retirement (SSA retirement) or Social Security disability (SSDI), you must work jobs that pay into Social Security. There are many jobs that pay into Social Security, including military service. It is easy to confirm if you pay into Social Security by checking your paystubs or yearly W-2.

Work Credits

You earn work credits by paying into Social Security. This means you can earn up to 4 credits per year. In 2023 you earn one quarter of credit for $1,640 in wages or self-employment income. In fact, you only need to earn $6,560 in 2023 to earn all 4 quarters of credits. This amount does increase slightly every year so be sure to verify the year amount with Social Security. You can easily check your earnings record by creating a Social Security Account. Additionally, you want to make sure you file taxes yearly as a confirmation of your earning record.

Self Employment

Social Security does have special earnings rules for some jobs and self-employment. If you are self-employed, you have to make sure to file taxes every year or your work earnings will not count. If your yearly self-employment earnings are less than $400 net, then special rules apply, which you can find here. Special rules also apply to farmers, domestic workers, and working for a nonprofit or religious organization that does not pay Social Security taxes. Call your local Social Security office if you have specific word credit questions.

SSA Retirement

The general rule for SSA retirement is that you need a total of 40 quarters of credits. This means you need to work and pay into Social Security for 10 years. You are guaranteed SSA retirement benefits once you have worked for the 10-year minimum. The years do not have to be consecutive, they just have to add up to 10. It is important to note that if you only work the minimum 10 years then your monthly SSA retirement benefit will probably not be very much. SSA takes the average of your yearly salaries to determine the monthly benefit amount, which is calculated in three different ways:

1. 35-year work history – SSA averages your salaries for all of your years worked.

2. More than 35-year work history – SSA will average your 35 highest earning years.

3. Less than 35-year work history – SSA will average all of the years you have worked.

If you did not work for a total of 10 years, or your earning amount was low, you may be able to get retirement benefits from your spouse if you are married more than 10 years. If your spouse earned enough of their own credits, you could be entitled to half of their retirement benefit amount. For example, your spouse is eligible for $2,000 per month in SSA retirement, which means you would be eligible for $1,000 a month in SSA retirement. The total monthly SSA retirement income for you as a couple would be $3,000 per month. This rule is true even if a couple has been divorced for many years and remain unmarried. You can read more about divorced spousal benefits here.

Social Security Disability Insurance

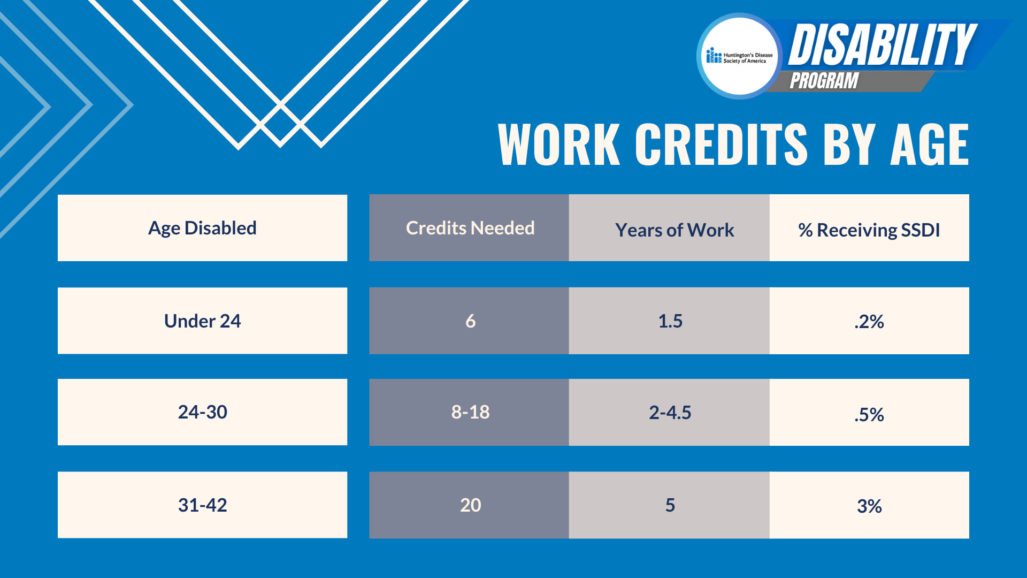

The general rule for SSDI is that you must have worked 5 out of the last 10 years. There are a different set of rules for individuals under age 31, which you can see in the chart below:

There are no exceptions for breaks in work for education or being a stay-at-home parent. This is why it is so important to apply for SSDI benefits as soon as you stop working, assuming you are also getting medical care for Huntington’s Disease. As a reminder, to be approved for SSDI you have to have enough work credits and have a medically diagnosed disabling condition with supporting medical evidence.

You can learn more about work credits and Social Security Disability in the HDSA Disability Booklet or by watching the Disability Chat: Work Credits and How to Qualify For Disability.